Now, this may veer into a hypothetical Travel Rewards 201 course, but I wanted to close the points acquisition side of Travel Rewards 101 by walking through a concept I’ve come up with that I think is important to keep in the back of your mind as you dive deeper into the world of credit cards, points, and miles. I call it:

The Opportunity Cost of Acquisition

Back in my Economics classes in college, we reviewed a key concept called “opportunity cost”. If you’re unfamiliar with the concept, the idea is that when making a choice, you should always consider what your next best option is when you make a decision. You may have seen the image at the top of this article from Family Guy where Peter has to make a decision between the boat that the salesman has just offered him and the “mystery box”. He ends up choosing the mystery box, which has free tickets to a comedy club. I use this just because it’s a humorous depiction where we can potentially make the wrong decisions by not considering what our other options are. Boiling down the concept of the “opportunity cost of acquisition”, the idea is to:

Always consider what else you could be earning by putting your spend on a given card

Scenario 1: Spending towards a Welcome Offer vs “Old Reliable”, a 2% Cash Back Card

Say I’m living in an alternate scenario where I decided not to sign up for that Sapphire Preferred card and instead decided to keep spending on my ‘ole reliable’ 2% cash back card. If I had decided to continue spending on your 2% cash back card, I would have earned rewards as well! For that $4,000 in spend, I would have earned 2% back in rewards, or $80.

The key idea here is that I am giving up the opportunity to spend on another “default” card by choosing to spend on the new Sapphire Preferred (or insert any other card in your scenario). In order to earn that ~65,000 Ultimate Rewards total, I gave up earning the $80 from the 2% cash back card, so I should think of the cost of these points as $80, because there truly is an opportunity cost here: I could have earned that $80 back if I went down that path. In this case, this is a fantastic trade, because I’m acquiring these 65,000 Ultimate Rewards for just $80. That would work out to 0.12 cents per point, while these points have a minimum value cashing out of 1 cent per point. This is a fantastic trade, and one that I would make often!

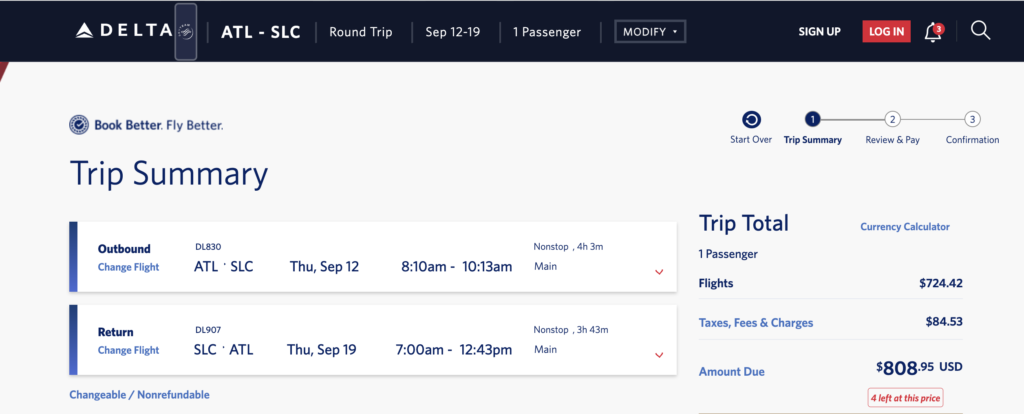

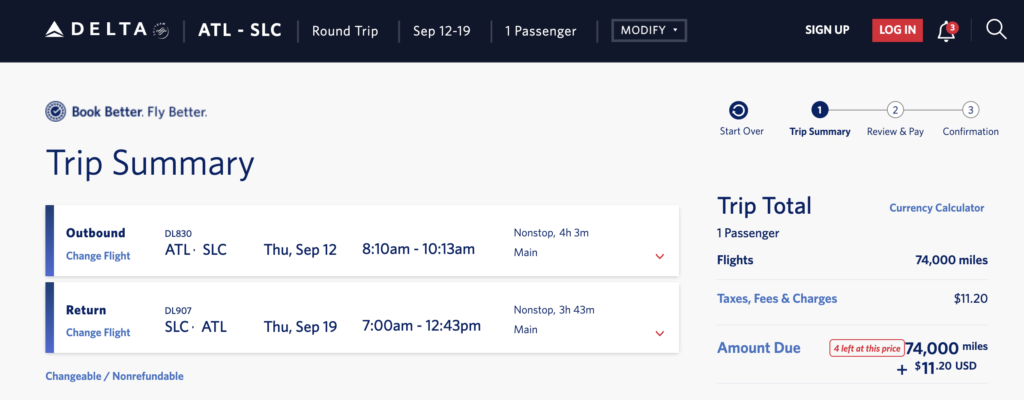

Scenario 2: My Old Airline Card vs 2% Cash Back

Because my SkyMiles likely aren’t worth 2 cents per point, I’m leaving value on the table by putting my spend on that card at 1 point per dollar. I could have bought a flight much quicker if I had just put my spend on a 2% cash back card: assuming I do all my spend in 1x categories, I would need to spend $63,000 to afford this flight on SkyMiles with the 15% discount, while I could spend $40,400 on a 2% cash back card to purchase the flight with cash.

This is an important reminder that even though it may feel great to get a “free” trip by using your hard-earned SkyMiles to book this trip, I would not say the trip is “free” at all, since you could have earned significantly more cash back with a better spending strategy.

Bottom Line:

The Opportunity Cost of Acquisition should be used as a guard rail to make sure that you are considering outside options, usually what you could be earning on an easy 2% cash back card, when considering where to put your spend. If you are earning less than that 2% cash back, keep this in mind, and consider adjusting your strategy to something more rewarding.

The bottom line here is that you should always keep your outside options in mind when deciding to spend money on a given card or pursue a given opportunity. We’ll cover other cases where cards incentivize big spending with bonuses outside the Travel Rewards 101 series, but it’s particularly important to keep in mind in a scenario like that. You can see that in some cases, such as the first scenario above where we compared spending on a Chase Sapphire Preferred as part of a welcome offer gainst spending on an old 2% cash back card that the welcome offer made a ton of sense. In other scenarios, it may make more sense to pick up that 2% card instead of spending on a card that doesn’t earn points very quickly, such as the second scenario where we walked through how earning one Delta SkyMile per dollar may not be a great reward.