Before diving further into the world of credit cards, points, and miles, it’s valuable to understand a bit more about credit cards and credit in the first place. I’ve spoken with many people that love the idea of diving into this game involving credit cards, points, and miles, but who are anxious or at the very least unclear about whether pursuing this path of signing up for credit cards will negatively affect their credit score or their finances in general.

Before diving into a few key rules here, it’s helpful to have a baseline understanding of what credit cards are financially, how to think about credit scores, and how you should and should not use them.

What are credit cards?

Credit cards are fairly ubiquitous in American society these days: almost every payment you make is likely with a small, rectangular piece of plastic that connects to a bank’s network to allow you to pay for goods and services. A credit card involves setting up an account with a bank like Chase or American Express where the bank will technically pay your bills up front (settlement periods aside for the purposes of this article), while you must then settle up with the bank at a later point. The credit card companies charge interchange fees, where merchants pay a fee to be part of the payment network and to allow customers the convenience of using credit cards, so the credit card company is earning a small percentage on all the spend you make at different merchants. Banks take your transactions and group them into time periods that correspond to one month periods called statement periods, and then request that you pay them back for the charges you’ve incurred, typically within a month of the statement end date.

You’ll notice that when you sign up for a card, there are terms and conditions around APR, which stands for Annual Percentage Rate, the interest rate that the credit card company will charge you if you do not pay your bill on the due date. This is a reminder that a credit card is technically a revolving line of credit, which means that the bank would technically lend you money to pay for your expenses in the first place, but would also charge you very high interest rates if you do not pay them back on time and in full. This interest rate, the APR, is typically VERY HIGH at above 20%.

For reference, an auto loan or mortgage, where most people do actually need to borrow money to make a big purchase, might have a rate that’s between 2% and 7% (higher these days due to the economy). This is all to say that credit card companies charge very high interest rates on your purchases, so you should NOT carry a balance or view a credit card as a true line of credit that would allow you to borrow money to pay for purchases you don’t have the funds to buy.

Will my credit score be negatively impacted by signing up for credit cards?

It’s also helpful to understand credit scores and how they are calculated. Credit scores are summaries of how credit-worthy you are: it’s a score that lenders can use to understand how trustworthy you are with money lent to you.

Many people are afraid to sign up for credit cards in fear of them negatively impacting your credit score. Here is a brief overview of how credit bureaus, the companies that keep track of your credit score and how good you are about paying back debt, calculate your credit score.

1. Payment History

Do you pay your bills on time and in full? Do you ever make late payments or not pay back debt?

2. Credit Utilization

How much of the credit you have are you using? It can be a negative if you are often using all of the credit you are given by a bank. In this sense, it can actually be beneficial to sign up for new lines of credit, like credit cards, because this can contribute to lower credit utilization.

3. Derogatory Marks

Do you have any record of bankruptcy or reported late or missing payments?

4. Credit Age

Banks like to see that you have well-established (older) lines of credit typically by using a metric called Average Age of Account (AAoA). For example, if you have three lines of credit, one that is 5 years old, one 3 years old, and one that is one year old, you would have an AAoA of 3 years. Older is typically better here.

5. Number of Accounts

Banks like to see some history of credit utilization, but a high number of accounts can be a small negative factor. In fact, it’s often better to have some credit history than none at all. From a bank’s perspective, it can be tough to understand how risky a customer you are if you have no or very little credit history, so some evidence is often better than none.

6. Hard Inquiries

This is the factor that most folks cite when worried about signing up for new cards. It is true that a hard inquiry, or a formal request for new credit, which occurs for most new credit card applications, temporarily decreases your credit score, but it is typically by a very small amount (2-3 points). I have applied for dozens of credit cards over the years and have not had any significant negative impact from racking up hard inquiries.

For more information on credit scores, I find CreditKarma is a great resource. Banks will also typically offer you free credit score updates as well if you use their products.

With that brief background out of the way, let’s dive into a few golden rules for using credit cards and pursuing this points and miles world.

Golden Rules of Using Credit Cards to Earn Points and Miles:

1. Always pay your bill on time and in full

Due to the very high interest rates you could incur by not paying your bill on time and in full, any interest from late payments or payments not made in full will wipe out any benefit you earn from the miles you rack up by spending on a credit card. It is NOT worth carrying a balance, meaning you would not pay your bill on time and for the full statement amount, in this hobby. Interest, late fees, and potential negative impacts to your credit score from not paying in full are not worth pursuing any carrot a credit card company is offering in the form of points. As you sign up for multiple cards, I recommend always looking at your statements as they close but putting Auto Pay on to make sure you are not missing key payments.

2. Do not purchase items that you would not otherwise purchase

If you don’t think you can meet that initial spend requirement in your normal day-to-day activities, I do NOT recommend changing your spending habits to make this happen. As an example, you should not decide it’s a good time to buy a luxury handbag or tickets to an expensive sporting event just because you need to in order to get those bonus points. If you do this, you’re spending money you wouldn’t have spent otherwise just to earn these travel rewards, wiping out any value you would gain by earning these travel rewards.

4. If you sign up for a card that earns bank points, don’t end your relationship with the bank entirely

We’ll get into more detail around the differences between earning points from a bank, such as Chase or American Express, and earning points from a hotel or airline program, such as Hyatt or Delta, in a future post, but one key distinction is how accounts are treated if they are with a bank compared to an airline or hotel’s loyalty program.

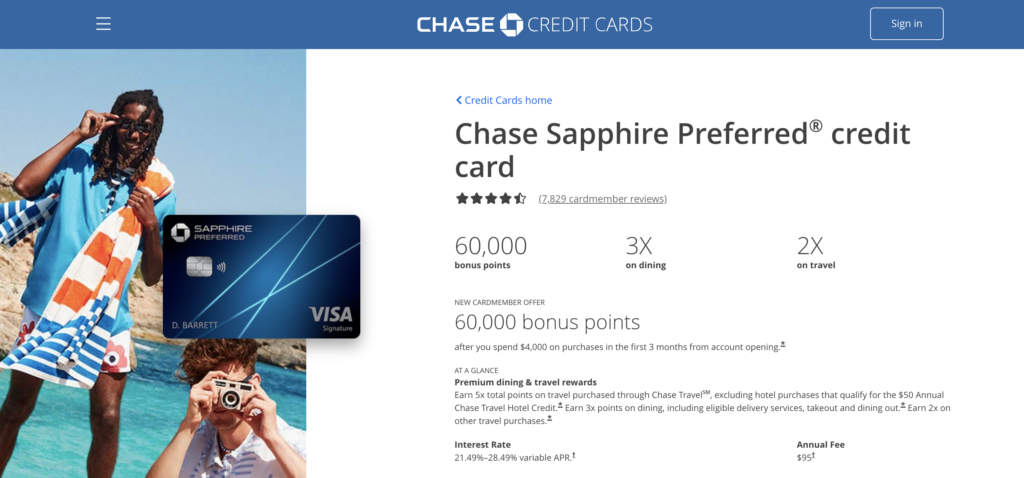

Typically, points earned with a bank such as Chase Ultimate Rewards or American Express Membership Rewards are only available to you while you have a card that earns those points: if I sign up for a Chase Sapphire Preferred, I only have access to those points while I have a card that earns Ultimate Rewards. If I close my account and no longer have any Ultimate Rewards-earning cards, I will lose those points. This is not true with hotel and airline cards, because those cards are earning you points and miles in your loyalty account with a company like Hyatt or Delta, not with Chase or American Express. We’ll discuss this more in future posts, but it may be worth Product Changing your card, or downgrading to a card you like more, rather than ending your relationship entirely to keep your points open and available.