I mentioned briefly in the first post in the Travel Rewards 101 Series that welcome bonuses are often the fastest way to earn large sums of points, and I wanted to illustrate an example briefly to underscore how lucrative a welcome bonus can be.

Scenario:

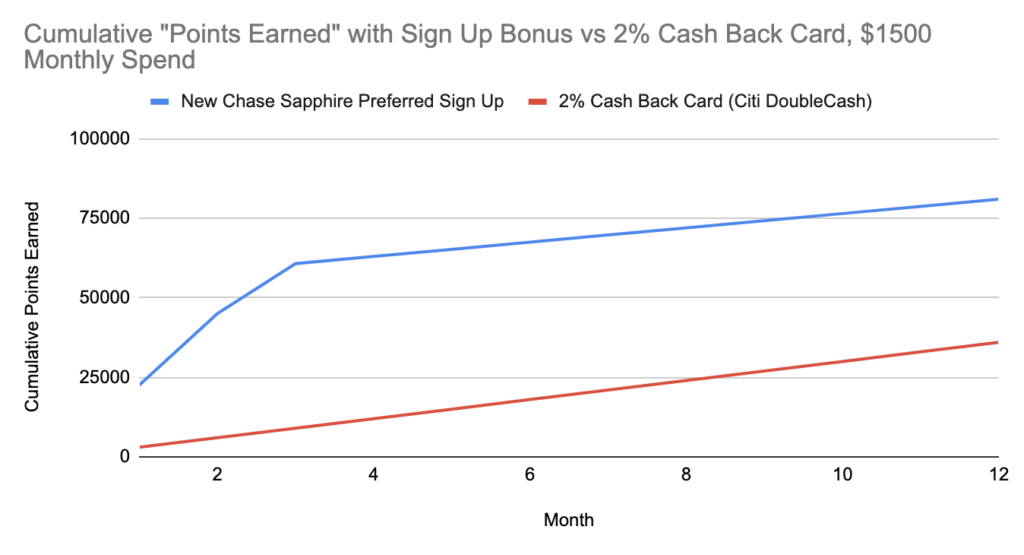

Let’s say my normal monthly expenses total to $1500. I currently have a cash back card, and let’s assume it’s a good one, such as the Citi DoubleCash card that earns 2% cash back on every purchase. The chart below shows the number of “points” I would earn in two different scenarios, one in which I sign up for a Chase Sapphire Preferred card, whose current sign-up bonus is 60,000 points after spending $4,000 in the first 3 months after card opening, and the other in which I continue to spend on my “old reliable” 2% cash back card.

For the sake of illustration, I’m assuming:

- The points earned from the sign-up bonus are earned over time, when in reality I would earn that 60,000 points all in month 3 in this scenario.

- We earn an average of 1.5 points per dollar on the Sapphire Preferred after the sign-up bonus

Either way, we can see that after meeting the spend on the sign-up bonus, we are well ahead of the scenario where we keep spending on a 2% cash back card. To compare the two, I’m saying that the 2% cash back card can be roughly translated to 2 points per dollar spent as well. At the end of the year, we come out 55,000 points ahead by signing up for the new Chase Sapphire Preferred card. Even when we subtract out that card’s $95 annual fee, we’re still ahead by several hundred dollars over the alternative option.

There are also many other cards besides the Chase Sapphire Preferred that offer sign-up bonuses, so the difference could become even larger over time. It’s easy to see how you could come out well ahead by signing up for a new credit card every so often.

This is also before we even consider the incredible ways we can spend points earned from credit cards like Chase’s Ultimate Rewards points: it’s reasonable that we could get even more value out of these points than comparing them to cash back at 1 cent per point!

Read on in the series for more advice on how to redeem points and miles.

Why would credit card companies offer sign-up bonuses?

Credit card companies always want to attract new customers to continue growing their member base! Welcome offers are strong marketing tools that can be used to entice customers into signing up for a new account. New accounts also bring in revenue for the credit card companies by bringing in new annual fees, interest expenses, late fees, and interchange fees. There may also be “breakage” with the sign-up bonus itself: some customers may think they’ll spend the required amount to earn the bonus but may forget to, so the bank doesn’t have to pay out the sign-up bonus. Credit card companies expect to make money off of their new customers, so they are willing to offer bonuses to get customers to join.

Luckily, this system works for us and the credit card companies. Read on in the series to get a baseline understanding of how credit cards work, how credit scores are calculated, and a few golden rules in earning points and miles from credit cards.