Let’s dig into a specific set of travel rewards called Transferable Points and why they hold so much value compared to other points and miles you can earn through credit cards.

Transferable Points Overview

Most of the key banks in the travel rewards space offer a currency of their own that don’t relate to a specific hotel or airline. For example, Chase offers their points, called Ultimate Rewards, while American Express offers their Membership Rewards points. Citi, CapitalOne, and WellsFargo now all have their own points as well, and all of these banks’ points share one thing in common: they can be used much more flexibly than points with one specific airline or hotel program, such as Delta SkyMiles or Hilton Honors.

In the next post, we’ll go into more depth on each of the key banks’ currencies, specific application rules to keep in mind, and cards on offer, but for now let’s walk through an example using Chase Ultimate Rewards to illustrate the handful of different ways you can use transferable points and why they can be so valuable.

Scenario: How to Use My Chase Sapphire Preferred Sign-Up Bonus

Let’s say that you just signed up for a new Chase Sapphire Preferred card, as we outlined in the previous post emphasizing how valuable signing up for new cards and meeting the minimum spend requirements for a welcome bonus can be, and you are now sitting on a nice stash of approximately 65,000-70,000 Chase Ultimate Rewards points. Let’s use 70,000 points as a nice, round number. Now that I have all these points, I want to plan a trip!

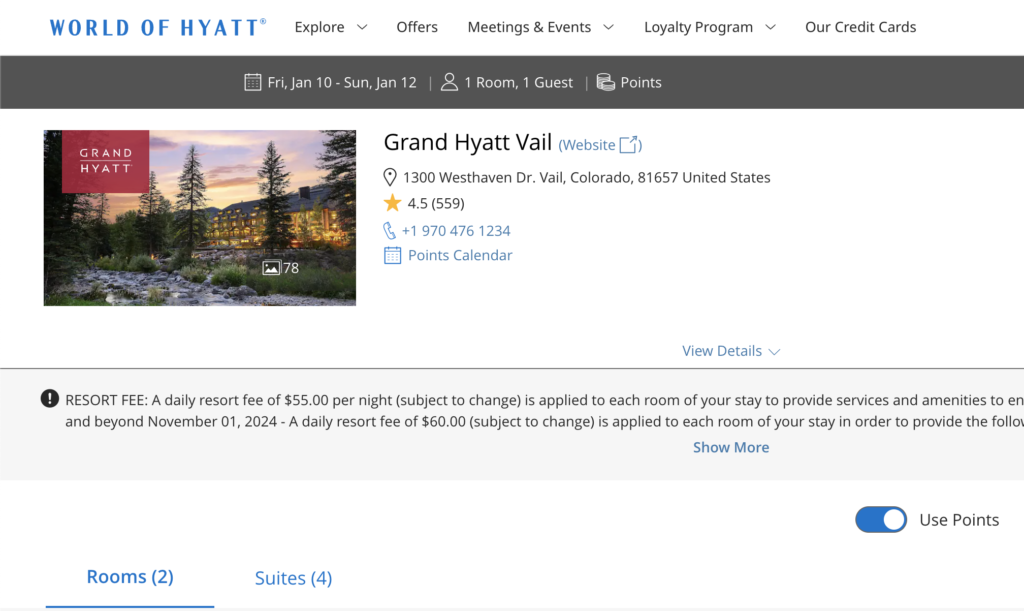

Let’s say that I’m an avid skier and decide I want to use my Ultimate Rewards to help plan a trip to Vail, Colorado to go skiing this upcoming January, picking 1/10/25-1/12/25 as an example. Chase gives me a few options with my Ultimate Rewards points to help fund this trip.

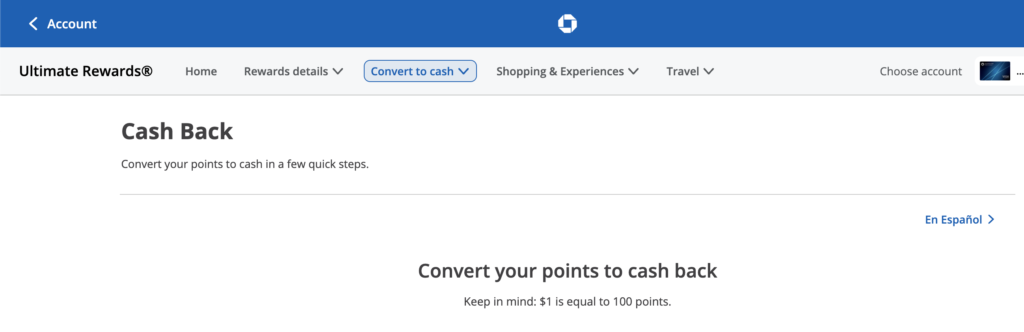

Option 1: Cash Back

Chase gives Ultimate Rewards members the option to “cash out” Ultimate Rewards points at one cent per point. You may see Cent Per Point abbreviated as CPP. I’ll use this abbreviation going forward. If I go into my Chase account and click “Redeem” next to my Ultimate Rewards balance, I’m taken to a screen like you see in the screenshot below. We can see that I have the option to redeem 100 points for $1, making my points worth 1 cent per point (CPP). If I go down this path, my 70,000 Ultimate Rewards points will be worth $700 towards travel. That’s not bad, and will certainly help towards the cost of flights or a hotel stay near Vail.

Option 2: Redeem Points for Travel in Chase’s Portal

Because my points are worth 25% more on travel ($875 specifically with my stash of 70,000 Ultimate Rewards), I can book more than one night at the Grand Hyatt Vail now. Excellent! I’m doing better than using these points for cash back. But… I can do even better!

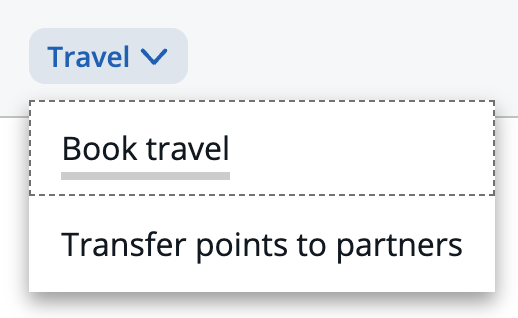

Option 3: Search for Award Availability and Transfer to Partner Program

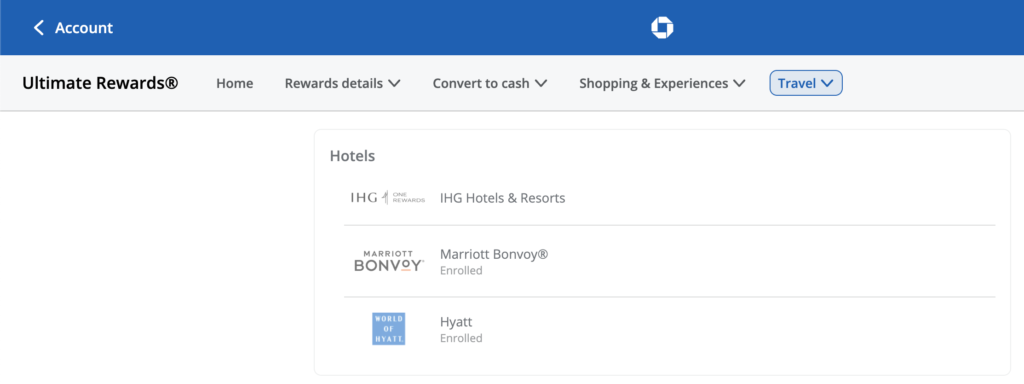

On this page, I can see that I have the option to turn my Ultimate Rewards points into rewards with a variety of other airline and hotel programs, with one Ultimate Rewards point equal to one point in whichever partner program I choose.

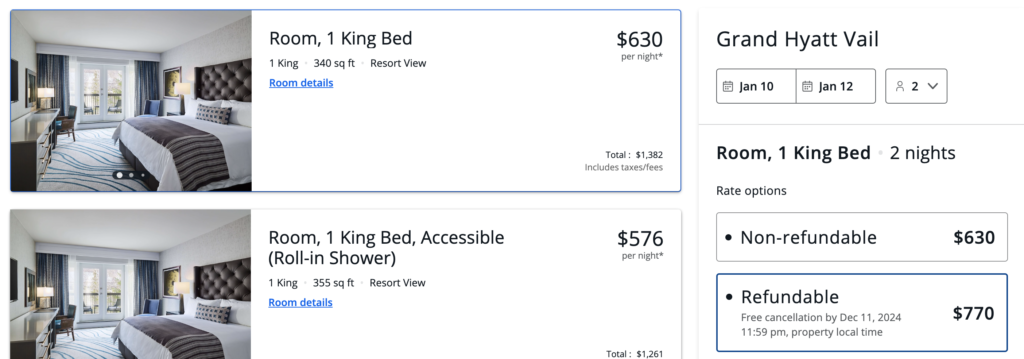

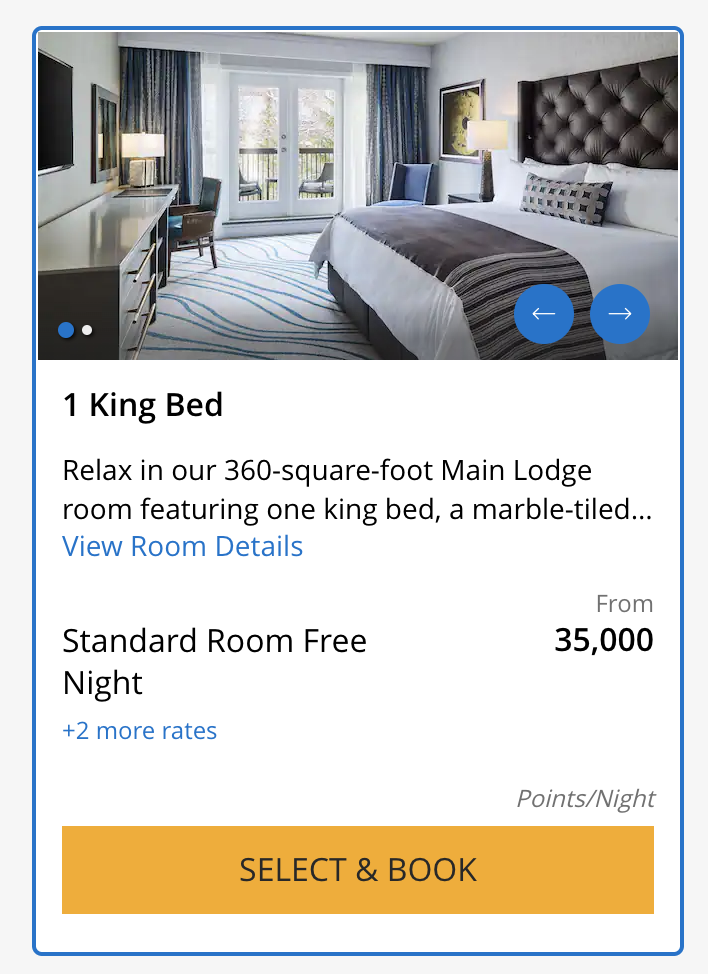

In this case, I found that the Grand Hyatt Vail looked like a nice property, and it’s associated with Hyatt and their World of Hyatt program. If I sign up for a World of Hyatt account and link it in my Ultimate Rewards account on Chase, I will then have the option to transfer Chase points and turn them into Hyatt points. If I check Hyatt’s website and search to see whether any rooms are available to use with World of Hyatt points for my same dates, I find that Hyatt is offering the same 1 King Bed room that I found on Chase’s Travel Portal for $770 (plus taxes and fees, which would increase the total to $847 for one night) for just 35,000 World of Hyatt points.

This is fantastic news! Because my Chase Ultimate Rewards are transferable to Chase’s partner, Hyatt, I can turn my 70,000 Ultimate Rewards points into 70,000 World of Hyatt points, which is enough to book both nights at the Grand Hyatt Vail and cover my weekend stay there! This would’ve cost me $1,684 with taxes and fees to book a rate that allowed me to cancel up to 30 days in advance, so my 70,000 points now completely cover this stay, meaning I got 2.4CPP ($1,684 / 70,000 points) for my Ultimate Rewards points. This is fantastic, and almost double the value of using my points in the Chase Travel Portal!

This is all entirely possible to do, and this example works out nicely at approximately the number of points you would end up with after your welcome offer on the Chase Sapphire Preferred.

Other banks’ currencies work similarly to Chase’s example that I’ve walked through here, and as you can see, the ability to transfer points to hotel and airline partners can provide tremendous value compared to using points for cash back or for travel directly. This is the key to the value of transferable currencies: transferring to partners unlocks an entirely different level of value for your points, and is worth digging into! I didn’t cover it in this example, but Chase also has a host of airline partners as well, meaning you have even more options to use your points beyond this specific scenario. In other words, you have the flexibility to use them how you best see fit.

In the next post in the series, we’ll review the currencies of each of the key banks and provide an overview for rules you’ll want to know before applying for each of their cards. Later on, we’ll highlight how to dig into the world of transfer partners to maximize the value of your points, as we walked through in this example.